Uploading a Tax Exempt Certificate

I am tax exempt. How do I upload a certificate so I am not charged tax on my order?

Uploading Your Tax-Exempt Certificate

Please note – if you are tax-exempt, you are required to create an account or login to your account to qualify for the exemption.

The tax-exempt application be can accessed by one of the following ways:

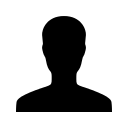

After creating your account, under the “My Account” screen, click on “Manage Tax Exemption.”

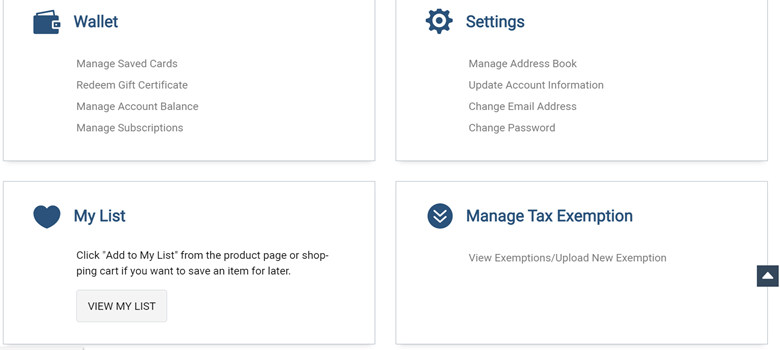

Alternatively, you can click the tax-exempt button above the checkout button after you have completed putting your items in your shopping cart.

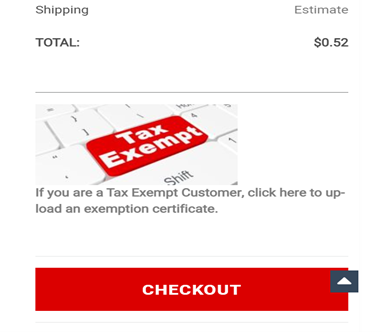

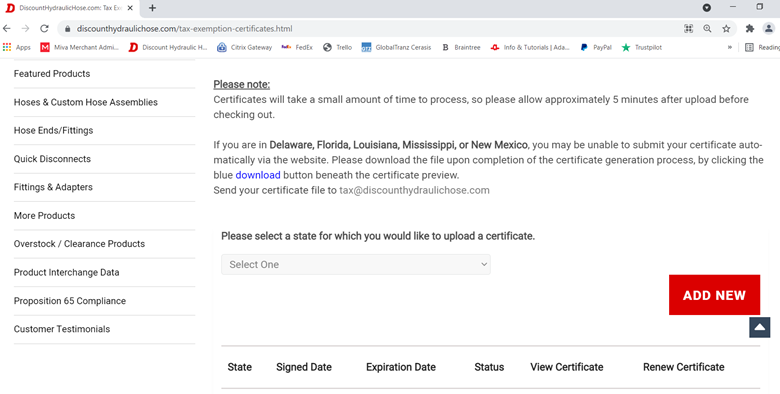

You will then be directed to our tax exemption portal page.

Next, select the state that you are uploading a certificate for and click the “Add New” button.

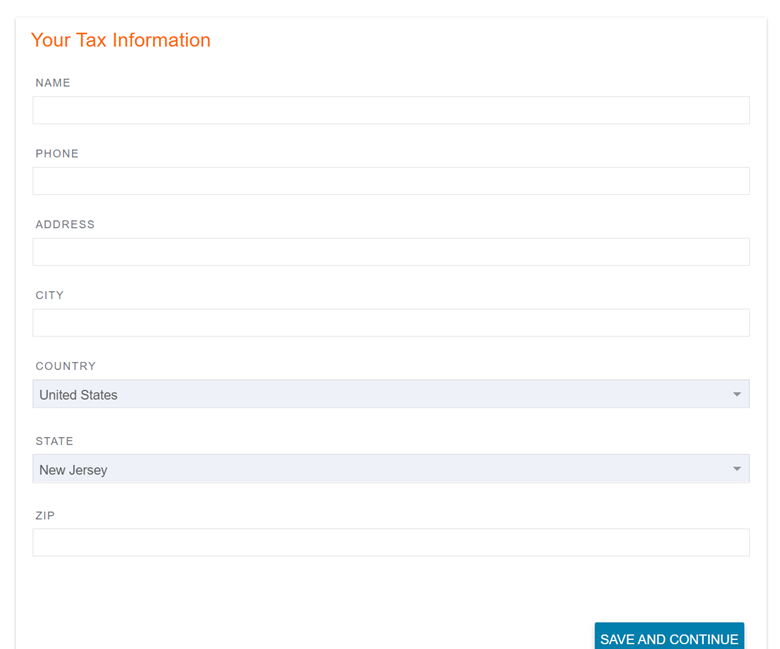

Fill out the information and click the “save and continue” button.

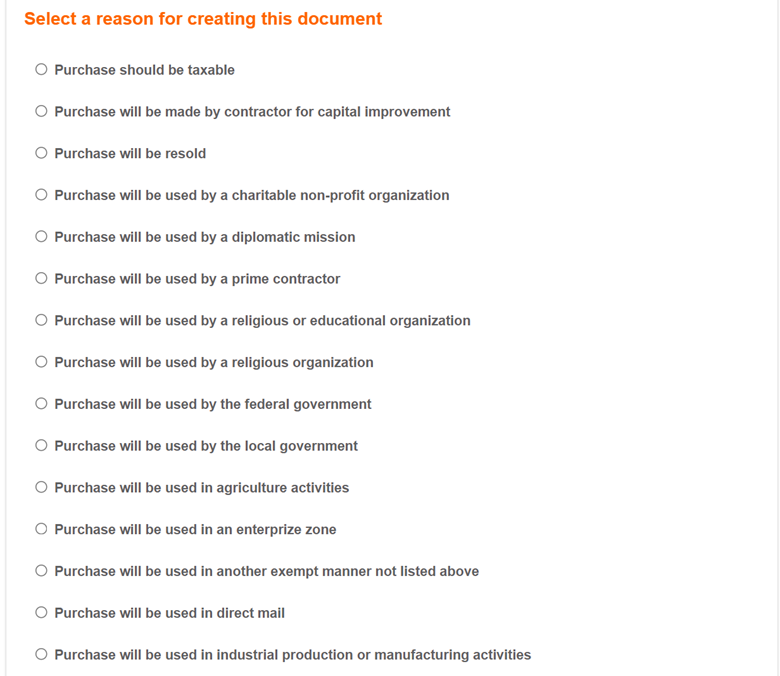

On the next screen, you will be asked to select the reason for your tax-exemption. Once selected you will once again click the “save and continue” button.

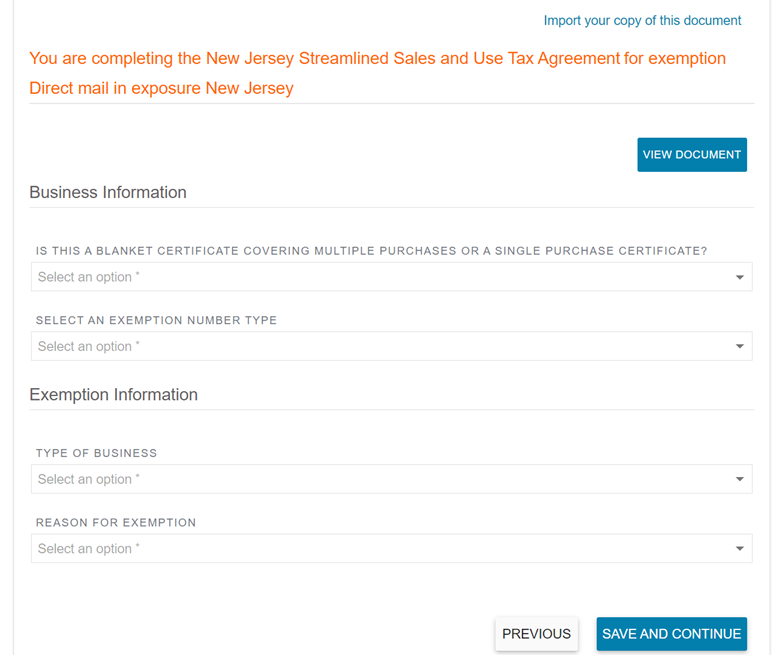

You will then be directed to enter information that is related directly to state and industry in which your business qualifies for tax exemption. Once complete, select the “save and continue” button. *This information will vary by state/industry. The below picture is an example of a purchase used in direct mail for the state of New Jersey.

The next page asks for the signer name, signer title, and electronic signature. Clicking “save and continue” will submit your tax-exempt certificate. Upon a successful upload, the following image will appear.

Your tax-exempt information will then be reflected in your account for ease of future purchasing. If at any time you have any issues with the tax-exempt process, please email us directly at: [email protected]

Leave a comment?